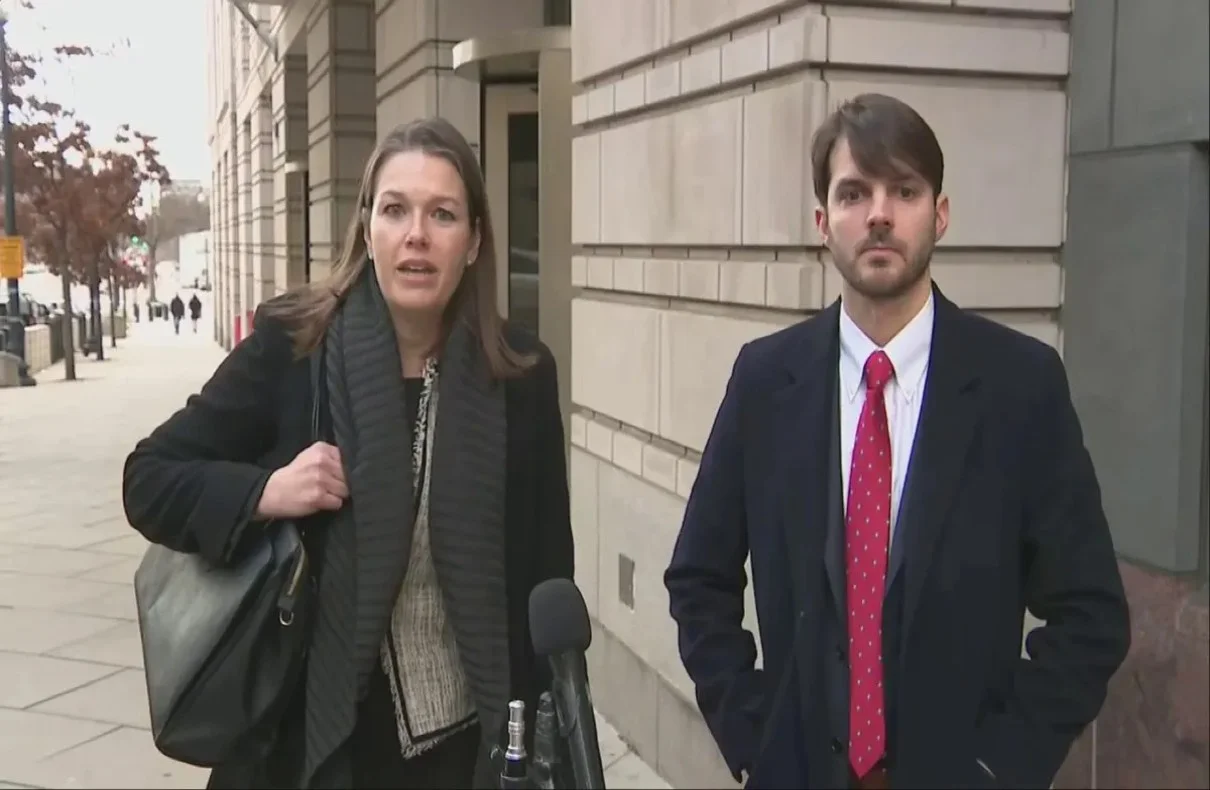

In a groundbreaking case that sent shockwaves through the political landscape, Charles Littlejohn, a former Internal Revenue Service (IRS) contractor, was recently sentenced to five years in prison for leaking the tax documents of former President Donald J. Trump and other wealthy Americans. The unauthorized disclosure of tax return information by Littlejohn was deemed unparalleled in the history of the IRS, leading to a significant punishment.

Charles Littlejohn, also known as Chaz, worked for the tax agency from 2017 to 2021 and took advantage of his position to steal the tax records of thousands of the country’s wealthiest individuals, including Donald J. Trump. He then provided this sensitive information to The New York Times and ProPublica. Prosecutors argued that Littlejohn’s actions were driven by his personal and political agenda, believing that he was above the law.

Littlejohn pleaded guilty to one count of unauthorized disclosure of tax return information. As a result, he was sentenced to five years in prison, making it one of the most substantial sentences in a federal leak investigation. In addition to imprisonment, Littlejohn also received three years of supervised release, 300 hours of community service, and a $5,000 fine. The severity of the sentence sends a strong message about the consequences faced by individuals who violate laws intended to protect sensitive tax information.

The leak of Donald J. Trump’s tax returns had garnered significant public interest due to the former president’s refusal to disclose them, breaking a longstanding tradition. The leaked documents were considered critical in understanding his wealth and business practices. The Internal Revenue Service had taken extra precautions to secure Trump’s filings in a special vault due to the public interest surrounding them.

Snoop Dogg and Master P Slam Walmart for Sabotaging Their Cereal Sales

Prior to his role as an IRS contractor from 2017 to 2021, Littlejohn had worked for Booz Allen from 2008 to 2013. Prosecutors argued that Littlejohn strategically sought his job as an IRS consultant to gain access to private tax information, specifically with the intention of leaking Trump’s tax returns. They claimed that Littlejohn considered Trump to be a threat to democracy, leading him to weaponize his access to unmasked taxpayer data.

While a free press and public engagement with the media are vital to a healthy democracy, stealing and leaking private, personal tax information strips individuals of the legal protection of their most sensitive data. The Department of Justice emphasized that there are lawful means to address concerns or shed light on issues, and violating privacy through unauthorized leaks is not one of them. Littlejohn’s actions were viewed as a long-term plan to violate Trump’s privacy, and the court aimed to send a strong message that such conduct is unacceptable in a nation governed by laws.

The sentencing of Charles Littlejohn, the former IRS contractor responsible for leaking Donald J. Trump’s tax returns, highlights the gravity of unauthorized disclosures of sensitive tax information. The case served as a reminder that individuals who violate laws intended to protect such data will face significant punishment. While the leak of Trump’s tax records generated public interest, it also raised concerns about privacy and the proper channels for addressing such matters. As the nation moves forward, it is essential to uphold the rule of law and safeguard the privacy of individuals’ financial information.